June 2009 (data compiled from 6/1/09 - 6/30/09)

June 2009 SMART Highlights & Q2 Review

U.S. Mobile Internet Reach:

- U.S. Mobile Internet increased to 59.8M users; Millennial Media now reaches 74% of the mobile internet or 44.2M users, according to Nielsen.

June Special Features:

- Top 10 mobile ad verticals in Q2: #1 Entertainment, #2 Telecommunications, #3 Portals, etc.

- Entertainment Knows Mobile. Movie Studios, in particular, have:

- Leveraged the mobile ad network model to reach, target and engage consumers.

- Delivered rich brand experiences on their persistent mobile sites, yet creatively leverage custom landing pages and rich media at different stages of the campaign lifecycle.

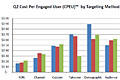

Engagement & Targeting:

- Monthly CPEU rates remained consistent in Q2 across multiple Campaign Targeting Methods, as did percentage changes among the Campaign Targeting Mix.

- Advertisers continued to invest in their brand’s permanent mobile presence. In June campaigns sending traffic to site as a campaign destination increased 10.46%.

- 48% of campaigns utilized Frequency Capping in June; remained consistent in Q2.

- Average session time increased significantly from 4:28 to 5:38 in Q2.

- 98% of page views featured only one ad request in June.

- The average monthly page views per user was 99 page views in June.

Device Highlights:

- 68% increase in iPhone& iPod Touch impressions on Millennial Media’s network in June.

- Apple’s impression share increased 4.20% in June; however, Samsung remained in the #1 position with the largest impression share throughout Q2.

- The iPhone regained the #1 spot‐this also contributed to the 1.4% month over month growth of Touch Screen device share versus other input mechanisms.

- The Blackberry Curve andBlackberry Pearl remainedconsistentlyin the#3 and #5 spots respectively month over month –while T‐Mobile’s HTC G1 (Dream) took the #7 slot in June.

Research Type(s):